The Next Generation of Startups Addressing Sustainable Aviation

The path toward a more sustainable aviation future is mission-critical for our planet.

Aviation emissions have risen rapidly, at an average annual rate of 2.0% since 2000.

The consequence: aviation alone contributed to nearly 1 Gt in CO2 emissions in 2019, or about 2.8% of global CO2 emissions from fossil fuel combustion.

Even though the pandemic has limited air travel activity by an unprecedented amount in the first half of 2020, as a result of global lockdown measures and government-enforced travel bans, aviation emissions remained high, driven by demand for cargo air travel and quickly recovering domestic passenger air travel markets in selected countries―for instance, China.

What’s the Outlook for the Next 10 Years?

Looking beyond the pandemic, total emissions from the aviation sector must be reduced.

Many of the operational and technical efficiency measures adopted by commercial airlines so far, including the renewal of aircraft fleets by replacing older jets with newer ones (which can lower average CO2 output per flight by up to 25%), are simply not enough.

While sustainability efforts like these have led to annual increases in total emissions (about 2% p.a.), staying significantly below overall growth in commercial passenger traffic since 2000 (about 5% p.a.), total emissions are still going up. To meet the IEA’s Sustainable Development Scenario―considered the industry’s golden ticket to achieving its publicly-announced climate goals―CO2 emissions must shrink by a staggering 7% through 2030.

For context, in 2016, the International Civil Aviation Organization (ICAO) set out climate protection targets for global air transport for the first time, as part of its CORSIA program. According to the ICAO, after 2020, air traffic shall only be expanded in a climate-neutral way. And more importantly, the aim is to cut CO2 emissions from air transport in half by 2050, compared to the base year of 2005.

Current Air Transport Climate Targets Are Insufficient

If this wasn’t challenging enough, recent research published by the German Aerospace Center in February 2021 concludes that while the CORSIA targets have the potential to mitigate the increased climate impact of air transport, the current measures will not be enough to support the 1.5-degree Celsius target established in Paris.

This is because non-CO2 effects―particularly the climate-warming effect of condensation trails―have not been taken into account. Adjacent research findings support this, concluding that contrails and nitrogen oxides have a greater collective climate impact on air transport than CO2 emissions alone.

With all that said, the challenge for the aviation industry couldn’t be greater. This is the industry’s most pressing hurdle since its inception in the early 20th century.

Which Technologies Have the Potential To Make a Difference?

Reducing oil use and CO2 emissions is particularly difficult from an engineering perspective, because of aviation’s energy and power density requirements.

“As of 2021, technically-viable alternative fuel technologies for aviation are still underrepresented. They are also likely to cost more than oil-based fuels in the initial stages. Aviation is price sensitive and also one of the most difficult sectors to decarbonize, so it will be important to exploit a wide range of promising opportunities, both in the near and long term”,

says the Sustainable Aero Lab mentor Nico Buchholz, an aerospace executive who spent over 15 years as head of fleet management with the Lufthansa Group and in other board positions in the Aviation Industry.

Since aviation is one of the most difficult sectors to decarbonize, most industry experts agree on the importance of exploiting a wide range of promising opportunities, both in the near and long term.

Basically, there are four technology fields that have the potential to push the aviation industry toward its long-term decarbonization goal, which we will present in the following sections.

-

1. The Digital Backbone

Digital technology, from the standpoint of analytics and big-data solutions, can have a great impact on current aircraft operations and planning systems, both in the air and on the ground.

Many steps in today’s airline operations stack are still handled by humans, yet they could be automated and optimized for greater efficiency―especially when it comes to limiting fuel burn.

For instance, airlines can support pilots by offering more efficient flight routing, by applying the latest optimization engines based on detailed weather forecasts and real-time air traffic updates. Fluent and automatic data- and information-sharing between airspace control centers would also greatly improve flight routing. Additionally, engine maintenance schedules can be adjusted based on data analytics to reduce MRO turnaround times.

Another potential area is air traffic management. Coordinating air space could yield great high-end data analytics benefits, especially considering that the sky will become increasingly crowded in the future―when cargo drones and air taxis are expected to enter the system.

The same efficiency gains can be exploited on the ground. Airports, for instance, could apply AI-backed software solutions to optimize departure and arrivals schedules, improve congestion management, predict accidents, and increase overall turnaround efficiency via computer vision, consequently improving airport utilization.

-

2. Sustainable Aviation Fuel (SAF)

On top of leveraging efficiencies in the current system―as described with the abovementioned tech solutions―sustainable aviation fuel (SAF), meaning low-carbon jet kerosene alternatives produced from recycled materials such as waste byproducts, offers enormous potential for reducing CO2 emissions in the short term.

In fact, SAF has the potential to cut CO2 emissions across their lifecycle by up to 80% compared to fossil jet fuel, depending on the sustainable feedstock, production method, and respective airport supply chain.

Therefore, SAF is less of a technology game-changer in itself, but more of an alternative fuel type whose production process needs to experience a lot of innovation in the coming years― because currently, efforts to develop SAF (specifically that which can be commercialized at a competitive cost and in a truly low-carbon manner) are only available in extremely low quantities.

However, the big advantage of SAF is that no entirely new infrastructure setup would have to be installed. Whether SAF or traditional jet fuel is stored at airports and pumped into planes, there will be no major difference for current supply-chain operations.

-

3. Electric (and Electric Hybrid Propulsion)

While SAF could provide an immediate (yet limited) solution for reducing CO2 emissions, more drastic approaches―namely, non-kerosene-based energy sources for propulsion―will be needed to tackle the environmental performance of aviation in order to make a real impact.

One of the potential prospects: electrification.

The major problem: aviation requires high-power output and energy-dense fuels. As the IEA concludes: “This limits (and makes more uncertain) prospects for fuel switching to become a promising means of decarbonization, for example by using renewable electricity to power batteries (...).”

And while current all-electric aircraft prototypes have proven to complete flights of more than 100 km, with the potential to operate on the scale of small to narrowbody aircraft based on advanced battery chemistries of sufficient size, these will be limited to upward of 1,000 km at best by mid-century. This will not be enough to provide an alternative to intercontinental flights.

An easier area for the electric revolution to drive change in the aviation context―at least in the short term―are ground operations. For services like passenger transport to the aircraft in buses, as well as the aircraft pushback service, electrified transport means are ideal candidates for cutting fuel burn.

-

4. Hydrogen

Last but not least, the biggest potential strategy for decarbonizing aviation over the next few decades could be hydrogen because, in the case of fuel cell propulsion, hydrogen acts as a de-facto zero-emission technology, as gaseous emissions are limited to water vapor―a byproduct of the energy production process.

The way hydrogen works is best explained here.

In summary, the advantages of hydrogen as a power storage technology over SAF and batteries are quite straightforward:

Unlike batteries, which need to be recharged, fuel cells can continue to generate electricity as long as a fuel source (hydrogen) is provided, enabling faster turnaround times.

Individual fuel cells can be “stacked” to form larger systems that can produce more power, thereby allowing scalability―and since there are no moving parts, fuel cells are silent and highly reliable.

Last but not least, hydrogen is superior to conventional fuel in terms of power density by unit weight. This is highly relevant for weight-critical flying, as it offers a maximum takeoff weight advantage over all other energy storage alternatives.

On the flip side, hydrogen has a lower volumetric density, meaning it requires four to five

times the volume of conventional fuel to carry the same onboard energy. Big tanks are needed, which may result in the A380 making a surprising comeback in the near future.

Long story short, hydrogen looks like the sacred path forward. But as always, the solutions that offer the greatest emissions reduction also require novel engine or aircraft architectures and/or novel electrical systems, as Roland Berger concludes.

In summary, hydrogen represents the most complex technology compared to alternatives like SAF and battery-based electrification. Also, the major question remains whether infrastructure needs and regulatory requirements will be addressed, to establish an environment where aircraft manufacturers and airlines find hydrogen solutions to be a competitive alternative to today’s jet-fuel engines.

Fortunately, a growing number of startups have eyed this engineering challenge, as we will learn in just a second. Also, the hydrogen investment pipeline across the globe has already grown to $500 billion in response to government commitments to decarbonization.

Air Taxis Won’t Solve Aviation’s Problems

Whenever the path toward decarbonizing the transport sector is discussed, some people will bring up air taxis as the one-stop solution.

We want to be clear: air taxis will have no impact on travel routes covered by today’s airlines, meaning distances longer than 1,000 km. They might change the way a few of us travel within cities, and slightly beyond that (think from Berlin to Hamburg)―meaning they might add an additional transport means to today’s transport mix―but nothing that will substitute long-distance travel means of transportation like planes or trains. In the best-case scenario, air taxis won’t add additional emissions on top of what the transport sector already generates. And this will be challenging enough because many experts even question the impact that eVTOLs might have on fixing urban traffic congestion―though this is an entirely different topic.

The latest “Economics of Vertical Mobility” report by Porsche Consulting gives a sobering, yet spot-on evaluation of the impact air taxis might have:

“Air taxis offer limited transport capacity due to the small number of passenger seats per eVTOL and a limited number of starting/landing slots per vertiport. We expect initial vertiport throughput to be below 100 passengers per hour. Even if Uber Elevate's (acquired by Joby Aviation) vision of megaports with 1,000 takeoffs and landings per hour [4] were to materialize, they could only handle a maximum of 3,000 passengers per hour, based on the assumption of a busy route and of three passengers per air taxi. This maximum throughput capacity is on par with that of a single-lane road that has a throughput of approximately 2,500 to 3,000 passengers per hour. For comparison: a subway can transport roughly 30,000 to 45,000 passengers per hour on a one-way route with 1,000 to 1,500 passengers per subway.”

The Role of Startups

Regarding which companies are able to drive forward all this technical innovation in the aviation industry, the answer would historically have been: only the two big aircraft manufacturers, Boeing and Airbus.

While Airbus publicly announced it will focus on hydrogen as the key technology of aviation’s clean future, with a goal of launching a hydrogen jet by 2035, Boeing has been more conservative in claiming the industry’s ecological renovation.

Fortunately, like with most industries in the 21st century, a wave of startups have formed in recent years, including those willing to enter the aviation context and guide the industry toward a more sustainable future. This is a promising development. We are convinced that disruptive innovation toward a sustainable aviation future would greatly benefit from a vibrant startup ecosystem that is arguably experimenting more boldly than the traditional group of aviation incumbents. A good example of this approach lies in the space-tech sector, where heavily-funded startups like SpaceX, Blue Origin, Virgin Galactic, and others have recently disrupted a playing field that was historically dominated by NASA and other national space agencies.

Stephan Uhrenbacher, founder and CEO of Sustainable Aero Lab:

“The startups receiving the most attention in aerospace recently have been doing space travel and urban air taxis. While these products make for exiting flying objects and satisfy human desire, neither air taxis nor putting more people in space address the problem facing commercial aviation: Flying needs to become carbon-free. And this needs to happen much faster than most people in the industry believe. It opens room for startups to provide components for future aircraft or even entire planes, but also new modes of operation.”

But who are the players addressing air travel in the real sense―that is, in terms of transporting passengers over long distances, from country to country and beyond oceans, in a more sustainable fashion?

Mapping the Next Wave of Sustainable Aviation Startups

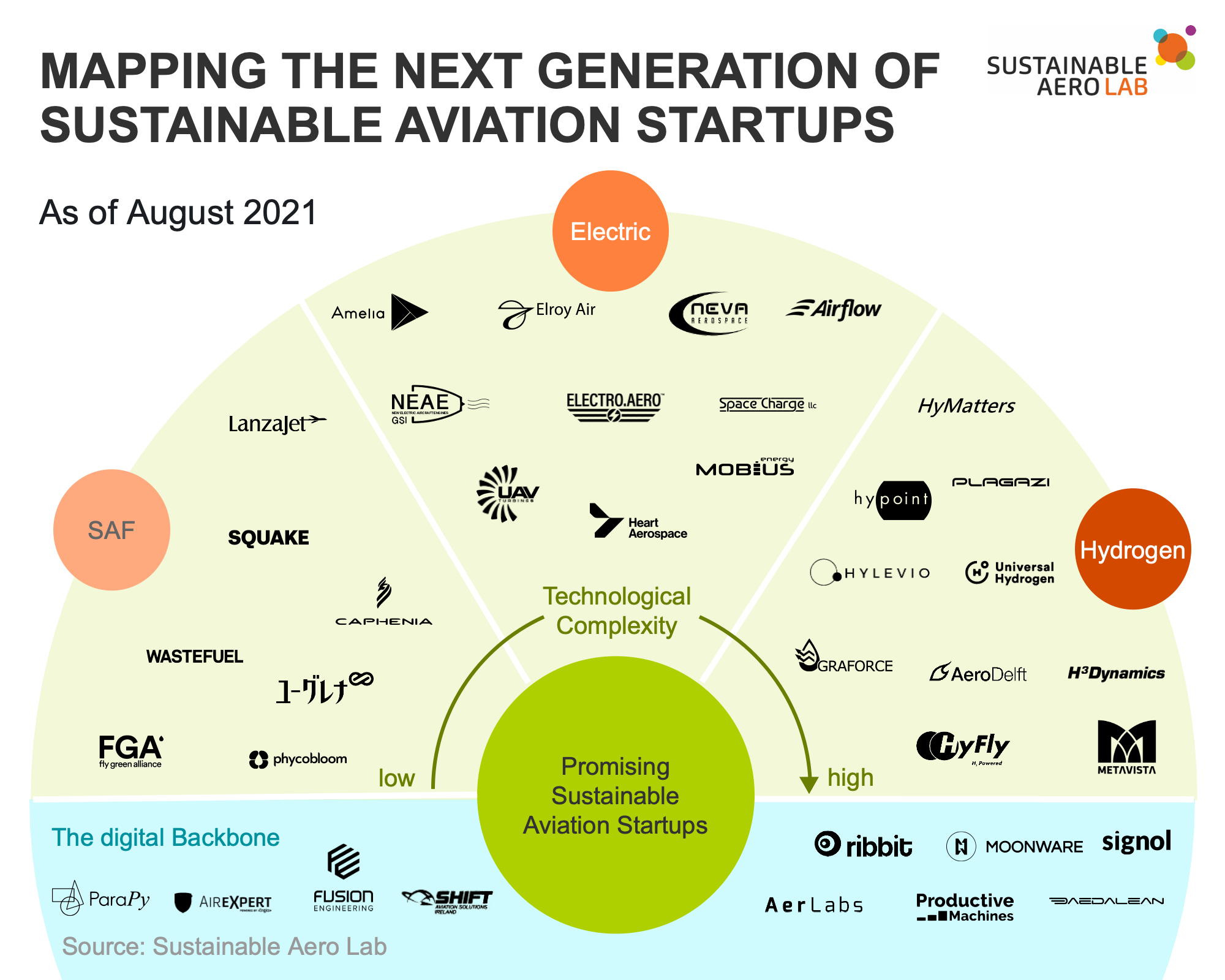

In the following mapping, we listed all the startups that we―the Sustainable Aero Lab―consider “the next generation of Sustainable Aviation.” We find these players extremely inspirational, having either stumbled upon them during our research over the previous months, or having already engaged with them during our initial startup mentoring programs.

It’s worth noting that we excluded all those heavily-funded air taxi and drone startups that you might have heard about in the news―for the reasons explained above. Instead, we really focused on startups of which many have so far flown, quite literally, below the radar of most aviation experts, especially given the fact that their ideas and technologies are, in most cases, still in the development stages with little real-world implementation. Notable exceptions are Heart Aerospace and Universal Hydrogen, which have attracted significant media coverage over the last months.

Here is our mapping of close to 40 promising startups working toward Sustainable Aviation.

As you can see from the mapping, we can mainly categorize next-generation Sustainable Aviation startups into four overarching categories:

Software-focused startups building the digital backbone of aviation’s future. This includes ventures like SHIFT, whose air traffic management solution creates better predictability, helping airlines reduce their aircraft carbon emissions

Startups experimenting with sustainable aviation fuel to reduce the carbon emissions of traditional aircraft, as in the case of Caphenia, which has developed a power-and-biogas-to-liquid (PBtL) process that converts CO2 and biogas into synthetic fuels, claiming CO2 reductions of up to 92% compared to conventional jet fuel.

Startups experimenting with electric propulsion in order to move the industry away from fossil fuels. Promising players include Mobius.Energy, which aims to build a battery subscription model that includes maintenance and salvage services for second-life repurposes, as well as the end-of-life recycling of batteries.

And last but not least, hydrogen startups working on the long-term goal of eliminating CO2 emissions from the aviation industry entirely―for example, HyPoint, which develops next-generation hydrogen fuel cell systems via turbo air-cooled fuel cells, based on proton exchange membrane (PEM) technology.

For more information on the startups listed in our infographic, please reach out to us at the Sustainable Aero Lab.

The Bigger Picture: Zero-Emission Tech

From looking at our Sustainable Aviation startup mapping, one might assume that the ecosystem of startups working toward a more sustainable aviation future is already well in progress.

However, this is not the case. Total venture capital funding—usually a strong proxy for gauging innovation dynamics—into all ~40 players of our mapping is practically nonexistent. Collectively, these companies have raised only a couple of million USD so far.

“Aviation is flying directly into a climate crisis. Yet most of the industry is focused on incrementally reducing or offsetting emissions, rather than eliminating them altogether. There is no time left to take this incremental approach; the effects of climate change are increasingly visible and impacting each of our daily lives. We need bold solutions that can deliver emissions-free commercial air travel in the next decade if we have any hope of reaching the goals of the Paris Agreement. The good news is that such solutions exist and represent a huge market opportunity,”

says Paul Eremenko, CEO and co-founder of Universal Hydrogen, and mentor in the Sustainable Aero Lab. With his own startup, Universal Hydrogen, the former CTO of Airbus and of United Technologies is playing an active role at the forefront of this activity himself.

Comparing this to the wider Zero-Emission Tech startup ecosystem—meaning all ventures working toward a sustainable, carbon-free future across industry verticals (so not necessarily only transportation or aviation-related)—we can see this dramatic funding scarcity of aviation players.

Since 2010, total fundings raised by Zero-Emission Tech startups have skyrocketed, especially after 2016, when funding more than doubled in one year.

In this overview, it becomes clear that the Sustainable Aviation sector is barely considered by investors at this point.

But this may change:

“You can’t wait for 10 years anymore, until you have a new aircraft developed. Startups could speed up the development by focusing on specific components such as propulsion units, or by developing practical upgrades to an existing platform, allowing them to go to market quicker and start solving environmental challenges at an earlier stage”,

says Sustainable Aero Lab mentor Dr Susan Ying, who serves as SVP at electric-flight startup Ampaire in her main role.

What’s interesting, when looking deeper into the funding dynamics of the Zero-Emissions Tech landscape, is that European startups have collectively raised only 13% of funding dollars since 2010.

This exposes a relevant finding we also made during our startup screenings in the Sustainable Aviation context: Europe is lagging behind in terms of startup dynamics, both measured in startup foundings and fundings.

The United States and Asia, despite their usually more conservative perceived positions in combating climate change, have produced more startups working toward a Zero-Emission Tech future. This tells us that the next-generation technologies leading aviation might not come from Europe.

However, on a more positive note, over the past two years, this situation has begun to change, as European climate-focused startups were able to take away funding market share from startups in other regions, particularly Asia (meaning China).

In 2020, European-headquartered Zero-Emission Tech startups were able to raise more than every fifth USD invested by Venture Capitalists. This indicates that European players have caught up to their American and Asian counterparts.

With all that said, what does the positive trajectory in terms of VC investments in Zero-Emissions Tech startups really mean for the future of aviation-focused players?

First, the funding perspective reveals that sustainable aviation from a startup innovation perspective is still in its absolute infancy. A couple dozen players are developing solutions to slash carbon emissions—see our startup mapping—but a lot more startup activity is expected to take place in the coming years.

Another data point proving this: despite hydrogen being considered the core technology lever to propel aviation toward its sustainable future, hydrogen startup funding is still critically low.

No more than 5% of all Venture Capital funding going into Zero-Emission Technology startups was raised by hydrogen-focused players in 2020.

The reasons for this are manifold—for instance, the timeframe of these hydrogen startups for offering market-ready products and solutions still lies far in the future, which isn’t particularly interesting from classic VC investment horizons.

What does this mean? Many of the hydrogen startups out there today have not sparked enough attention from investors. This is one of the reasons why we, the Sustainable Aero Lab, aim to support promising hydrogen startup founders—and others working toward sustainable aviation—to be better prepared, in order to attract investment dollars. We intend to transform inexperienced startup founders with great ideas, but maybe less go-to-market experience, into commercially-aware business leaders.

The Leading Hydrogen Startups

The mere fact that it’s possible for hydrogen-focused startups to attract the mega-fundings needed to take the technology to market shows the ranking of the few multi-million-dollar-funded hydrogen ventures.

As you can see from the table below, ZeroAvia, for instance—a company focused on the aviation context—has made it onto this list by developing practical zero-emission aviation powertrains that are already applicable today. Also noteworthy is that the company has recruited a team with proven success and deep experience, advised by top experts across the aviation, automotive, fuel supply, and real estate industries.

“Long-range, light-weight and fast-charge hydrogen electric propulsion addresses the limitations in battery-electric flight, while ushering in net-zero or even carbon-negative opportunities – making hydrogen the next big thing in aviation”

says Lab mentor Taras Wankewycz, founder of Hyzon and H3 Dynamics, and one of the few persons with a long track record in the hydrogen segment. But he adds:

“While safety and regulatory barriers extend commercial time frames, VC investors will need patience and a long-term strategic approach to the sector”.

Conclusion

The aviation industry is at a crossroads. In the face of growing pressure to address its impact on climate change―pressure from consumers, capital markets, and politicians―the industry must respond by going beyond current efforts to slash carbon emissions. While aircraft and jet engine manufacturers have realized impressive fuel efficiency gains in the past half-century, most of these improvements have been incremental. However, the winning formula to cut total emissions in half through 2050, as requested by CORSIA, requires a mix of continuous improvements of current technologies (i.e., digital technologies to increase efficiencies in the current system, and sustainable aviation fuel to achieve less pollution in today’s jet engines) AND, more importantly, revolutionary solutions (i.e., in the form of electric and hydrogen-based flying).

Fortunately, a growing number of startups are addressing this complex challenge, some of them with promising approaches and market-ready prototypes. However, the Sustainable Aviation startup ecosystem is still in its earliest stages, seeking financial support from Venture Capitalists, governments, and academic institutions to get off the ground.

Moreover, cross-industry collaboration is needed to unlock the technology’s full potential for aviation. Startup founders, aviation experts, experienced mentors, and active industry players―including investors and universities―need to come together to pull off the next revolutionary phases toward sustainable aviation. If you belong to one of these stakeholder groups and are interested in driving forward the sustainable aviation revolution, please reach out to us at the Sustainable Aero Lab.

About Us

The vision of the Sustainable Aero Lab is to make climate-neutral aviation a reality.

We strive to identify and help startups and projects that can prove their tangible impact on the reduction of the climate footprint of aviation.

We do this by bringing together startups, experienced mentors, investors, universities and industry players into one room where startups receive highly focused feedback in a transparent live session, four times a year.

If you are interested in joining our program, reach out to us, right here.